ALM 101: Introduction to Asset/Liability Management – Part 2: Interest Rate Risk – Earnings at Risk

Abrigo

FEBRUARY 24, 2022

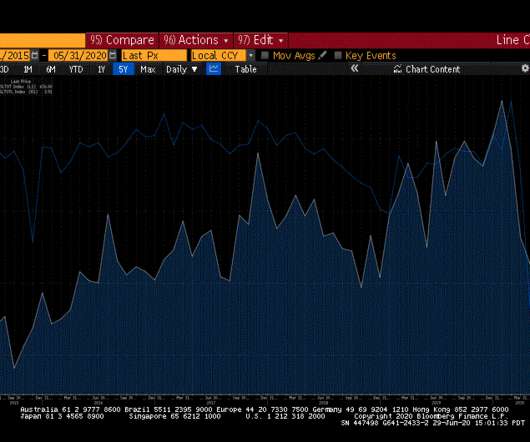

Takeaway 1 Interest rate risk for financial institutions is the risk that earnings and market value may decline as market interest rates change. . As described in the first post of this series , a key component of effective asset/liability management (ALM) is managing risks. Earnings at Risk.

Let's personalize your content