Why The Customer Experience Is A Program, Not A Project

PYMNTS

SEPTEMBER 17, 2020

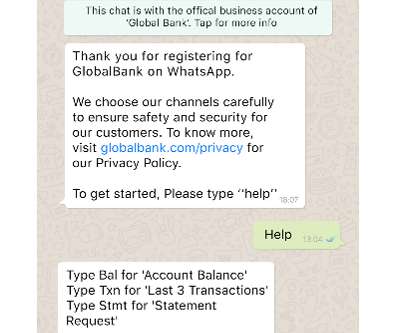

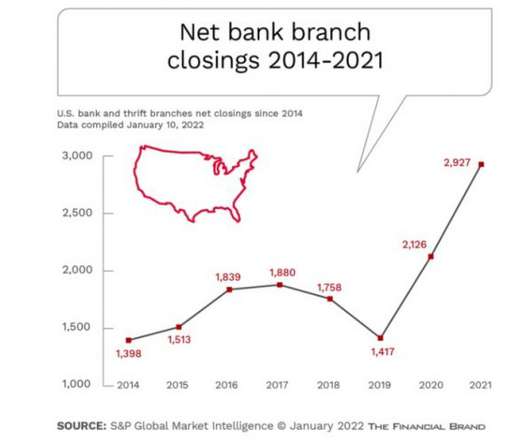

The pandemic has reshaped how we interact with merchants — and what we expect, as customers, from those increasingly digital interactions. Call it the transformation of CX, shorthand for the customer experience. It’s not enough that the CX be secure — though that’s critically important, of course.

Let's personalize your content