IdentityMind On The Need For FinTech Compliance Marketplaces

PYMNTS

SEPTEMBER 6, 2018

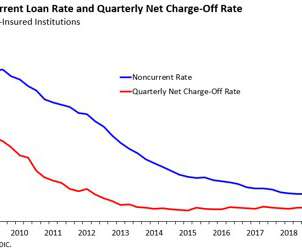

Compliance and risk? Automating that compliance is now a “need to have.”. Compliance and risk officers have the unenviable task of finding out, sometimes after the fact, that not all the boxes are checked — if they even knew the boxes were there for checking in the first place. Plugging In To Plugins.

Let's personalize your content