How 5G Will Shake Up Banking and FinTech?

PYMNTS

DECEMBER 12, 2018

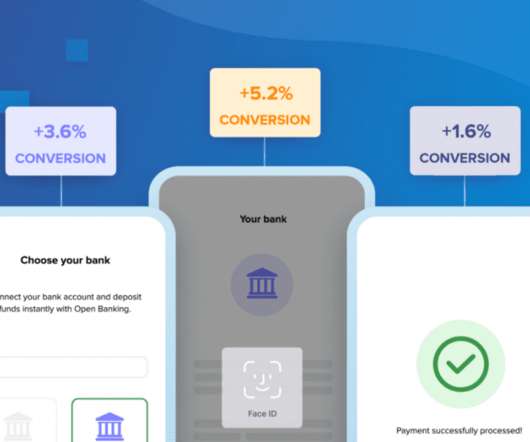

Financial institutions are in the midst of becoming more mobile, with many of those legacy operations opting to — or at least considering — working more closely with FinTech providers to upgrade services, retain customers and acquire new ones. The debut of 5G promises to add another tool that can aid such efforts. Digital Demand.

Let's personalize your content