Going digital: Two speeds for growth market banks

Accenture

AUGUST 2, 2022

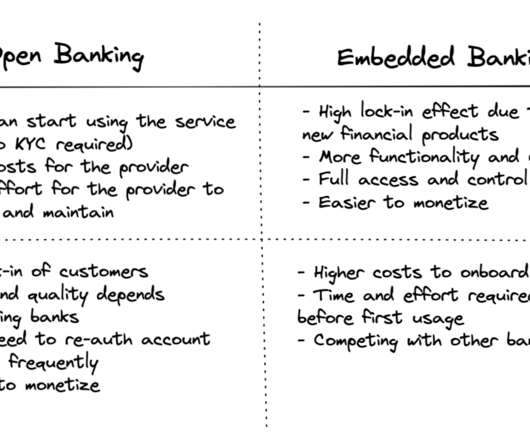

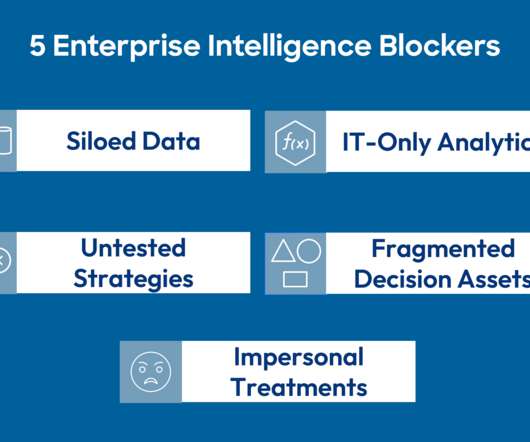

Flat economic growth and rising competition are forcing banks in growth markets to step up investment in digital technologies. They’re eager to improve efficiency, enhance the user experience and create new business opportunities. They view such large-scale change as…. They view such large-scale change as….

Let's personalize your content