Creating a Deposit Advance Product to Boost the Customer Experience

Perficient

MAY 6, 2022

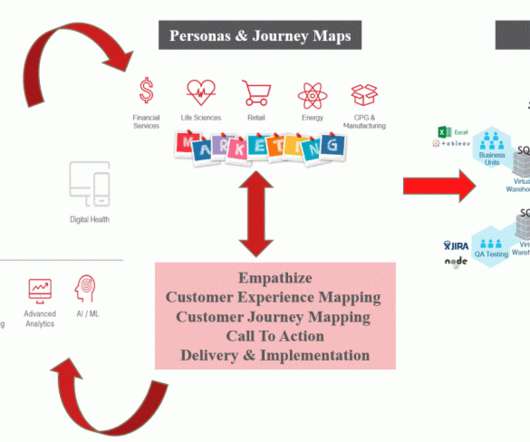

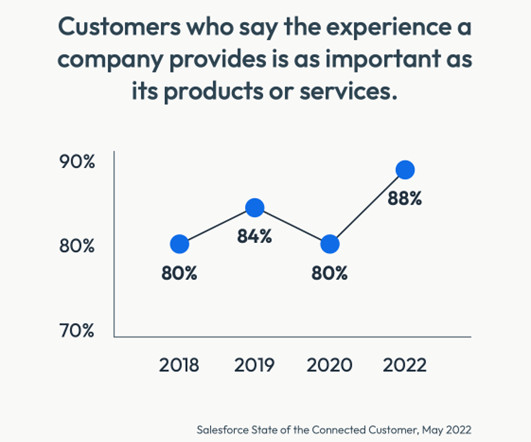

According to industry research, 73% of all people point to customer experience as an important factor in their purchasing decisions. Moreover, customers in the financial services industry are increasingly interested in using their go-to firm to cover more of their needs, rather than using multiple providers.

Let's personalize your content