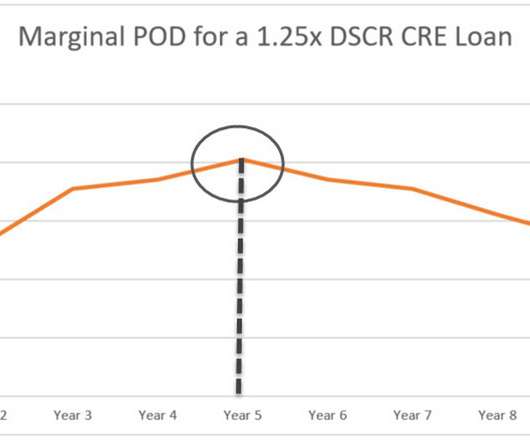

The Steps and Tools For Tactical Loan Refinancings

South State Correspondent

OCTOBER 9, 2023

A community bank may increase ROE substantially by using internal refinancing strategies to secure its top relationships that provide cross-sell opportunities, efficiencies, fee income, and growth opportunities. These “tactical loan refinancings” are a method for banks to manage credit risk and profitability.

Let's personalize your content