OCC Highlights, AML & CRA Risks

Perficient

DECEMBER 27, 2023

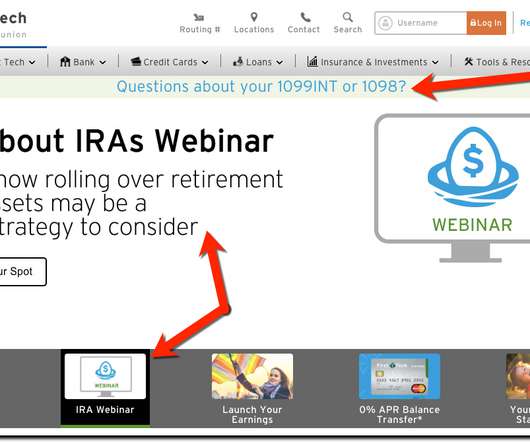

Once published by regulators, Perficient’s Risk and Regulatory CoE will be here to walk our clients through the changes. YOU MAY ENJOY: Regulatory Reporting in Financial Services Modernizing CRA Regulations Managing compliance risk frameworks in alignment with existing risk profiles is crucial as customer needs evolve.

Let's personalize your content