FICO’s Take On Debit Security

PYMNTS

JANUARY 30, 2020

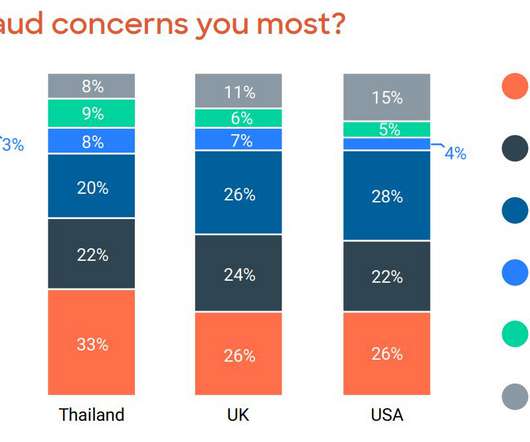

Financial institutions (FIs) cannot simply expect the popularity of debit to persist unaided, however, and must continue to innovate to keep fraud rates at a minimum. Debit network PULSE recently sought to boost its security by adopting a FICO fraud detection platform that can help it quickly detect and respond to suspicious activities.

Let's personalize your content