Banks Earning Over $10m Experience Spike in Fraud Attempts in 2021

Banking Exchange

JANUARY 10, 2022

Fraud cases increased by 343 between 2020 and 2021 Risk Management Security Cyberfraud/ID Theft Operational Risk Feature3 Feature.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Banking Exchange

JANUARY 10, 2022

Fraud cases increased by 343 between 2020 and 2021 Risk Management Security Cyberfraud/ID Theft Operational Risk Feature3 Feature.

PYMNTS

DECEMBER 9, 2020

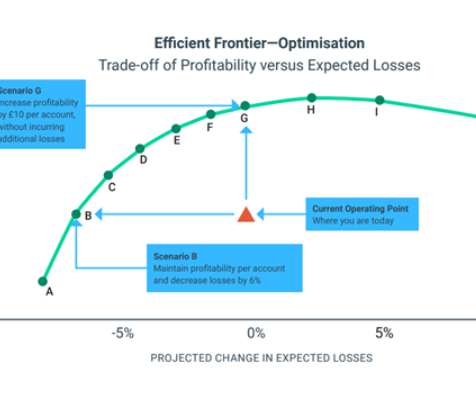

Managing credit risk used to be a reactive process. Bank customers would fall behind on their payments, and their banks might react by imposing fees or having a case manager work with them to bring their accounts back up to speed. In severe cases, banks might have to take the drastic measure of closing accounts altogether.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

AUGUST 22, 2022

Emerging Check Fraud Trends to be Aware of It seems check fraud will never go away, it just changes its approach every opportunity. You might also like this webinar, "Balancing compliance risk & reward with high-risk businesses." Check Fraud. Still the number one type of fraud in banking.

Perficient

APRIL 2, 2021

fraud detection and financial crime monitoring). email, text, audio data), with the aim of identifying fraud or anomalous transactions. These technologies are also used to better target marketing in retail and customize trade recommendations in wealth management. Risk Management. Email: 2021-RFI-AI@cfpb.gov.

BankInovation

FEBRUARY 10, 2022

Digital is a low-risk, high-reward environment for cyberattacks, Andy Renshaw, senior vice president at fraud and risk management company Feedzai, told Bank Automation News. Account takeovers increased threefold between 2019 and 2021, according to […].

FICO

JANUARY 12, 2022

The changing global regulatory landscape and ever-shifting fraud vectors are just two of the biggest challenges facing financial institutions. I recently sat down with Sidhartha Dash, Research Director at Chartis Research, for a conversation about the technology and trends in enterprise fraud management.

Perficient

SEPTEMBER 16, 2022

Risks Highlighted by the Fed in the Supervisory Letter Include: Money laundering – The letter emphasizes that crypto-related financing poses heightened risks associated with the governance of the underlying network as well as cybersecurity. Financial risk. Legal risk.

Gonzobanker

DECEMBER 17, 2021

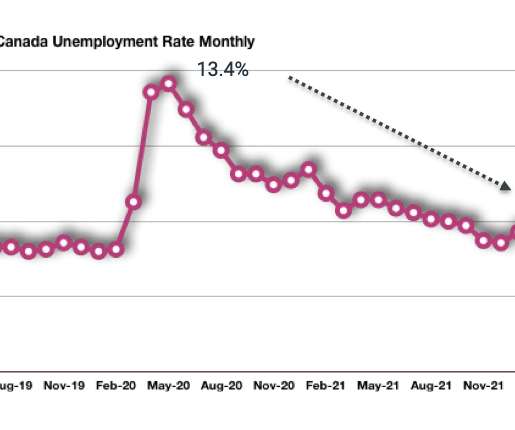

Gonzo readers, 2021 was just plain schizophrenic. 2021 fintech investments, merger activities, and overall focus were off the charts. Two, read and enjoy the 2021 GonzoBanker awards, our annual take on the best things we saw during the year. So which merger was the best in 2021? Doug Larson. THE BANKER AWARDS.

FICO

DECEMBER 15, 2020

It is true that the pandemic has accelerated the majority of digital trends and challenges this past year; I believe the “COVID effect” will persist strongly into 2021, which brings me to three broad predictions: Consumer spending patterns will remain in flux, requiring financial institutions to keep their guard up as fraud patterns change quickly.

Abrigo

JUNE 3, 2021

Takeaway 2 While crypto crime fell in 2020, there are many risks financial institutions must be aware of. Takeaway 3 To fight cryptocurrency-related risks and mitigate losses, be vigilant and stay on top of fraud trends. By Hannakah Rubin, Risk Management Consultant at Abrigo. Fraud Prevention. Fraud Trends.

Banking Exchange

JANUARY 27, 2021

Data indicates that global crises like COVID-19 present a ripe environment for spikes in financial crime Compliance Risk Management Compliance Management Compliance/Regulatory AML & Fraud BSA/AML Security Feature3 Feature Covid19.

FICO

MARCH 5, 2021

Also managing radically different customer behavior and suddenly having a workforce that was predominately working from home. Look no further than the recently published Chartis Financial Crime Risk Management Systems: Enterprise Fraud Market Update and Vendor Landscape , 2021, where FICO was named as the top enterprise fraud Category Leader.

FICO

DECEMBER 1, 2020

I’m delighted to announce that FICO has been named as the Category Leader for Financial Crime - Enterprise Fraud in the recently published 2021 Chartis RiskTech 100. Additionally, FICO was recognized as one of the top six overall risk management technology vendors and won Category Leader for AI Applications.

FICO

DECEMBER 10, 2020

In 2021 I believe AI will cross the chasm, becoming a reliable and safe, mainstream business technology — but maybe not how, or for reasons why, you might expect. This is despite one-half of survey respondents reporting having strong model governance and management rules in place to support ethical AI usage.

Independent Banker

JANUARY 31, 2022

Source: Cornerstone Advisors, “What’s Going on in Banking 2021: Rebounding from the Pandemic,” 2021. A recent report by Cornerstone Advisors found that bankers are either strongly interested in or already working with fintechs in three main areas: digital account opening (71%), mobile wallets (41%) and fraud/risk management (47%).

FICO

DECEMBER 2, 2020

New dates have been announced for FICO World 2021 , the Decisions Conference. . FICO World 2021. November 8-11, 2021. The world’s economy has changed, consumer behavior has changed and your operations have changed — at FICO World 2021, we’ll explore best practices and ideas for the new normal. Orlando, FL.

FICO

MAY 27, 2021

A Dozen Top Achievers in 2021. Earlier this year we provided a list of the winning companies in our 2021 FICO® Decisions Awards. Volvo Cars transformed its customer onboarding experience using decision management technology in the cloud to digitize and accelerate the process for its new vehicle subscription service, Care by Volvo.

Abrigo

DECEMBER 2, 2021

But impulse buying – whether at home or in business – can result in waste, so think carefully about areas of your bank or credit union that could benefit next year from a small investment as 2021 draws to a close. 31, 2019, and June 3, 2021, according to the Community Banking in the 21st Century report. billion from $515.3

FICO

APRIL 5, 2022

Itaú Unibanco, the largest private sector financial institution in Latin America, has migrated its fraud management and customer communication to the cloud, helping it to avoid over USD$20M a month in fraud losses. We processed more than 3 billion transactions in 2021. How FICO Can Help Improve Your Fraud Detection.

FICO

MARCH 30, 2023

Both from a cash and a fraud perspective, my curiosity was piqued, and I fell down the rabbit hole to learn more. Fraudsters Love Digital Real-Time Payments All this rapid change is great for one thing — fraud. billion in losses to investment scams alone in 2022, more than double the losses from 2021. Where Did My Cash Go?

The Paypers

JULY 21, 2022

Fraugster , a Germany-based payment intelligence company which offers compliance, chargeback protection, risk management solutions, and credit scoring via one AI platform and one integration, has published its first Payment Intelligence Report 2022.

Abrigo

MAY 10, 2021

Takeaway 2 Process management features of a loan origination system help manage the workflow, from analysis through closing. A loan origination system (LOS) should perform several basic functions to automate and manage the end-to-end steps in the commercial loan process. LOS process management features.

Independent Banker

MAY 31, 2022

Fraud and cyber attacks are on the rise, and at great expense to the industry. Here are some ideas for strengthening fraud defenses. Fraud and cybercrimes continue to increase, causing challenges for community banks. Fraud-fighting recommendations. Illustration by Cnythzl/iStock. By William Atkinson.

FICO

DECEMBER 15, 2020

I’m thrilled that FICO has been named as the Category Leader for Innovation in the recently published 2021 Chartis RiskTech 100. Additionally, FICO was recognized as one of the top six overall risk management technology vendors and won Category Leader for AI Applications and Financial Crime-Enterprise Fraud.

Abrigo

MARCH 24, 2023

Step two Identify inherent risk vs. residual risk Inherent risk is any activity or factor posed to the credit union, notwithstanding applying any management or risk mitigation tools. This example is a situation with a "high" inherent risk and "strong" mitigating controls.

The Paypers

MARCH 4, 2021

Cloud-based risk management platform Feedzai has announced its Financial Crime Report Q1, 2021.

FICO

DECEMBER 23, 2020

Here is how we predict banks will endeavor to enhance their financial crimes controls in 2021: 1. Now compliance professionals will also need to concern themselves with mitigating ransomware sanctions risks (i.e., Machine Learning Will Play a Great Role in Fighting Money Laundering.

CB Insights

OCTOBER 20, 2021

Here’s what they’ve achieved (as of October 2021): 2 of the winners have gone public. Bakkt announced a SPAC merger in January 2021 at a $2.1B The digital asset management platform completed the transaction and went public in October 2021. Crypto exchange and wallet Coinbase made its public debut in April 2021 at a $65.3B

Abrigo

JANUARY 22, 2024

6 Steps t o mitigate fraud risk tied to new products Your AML and fraud teams' input is key when it comes to offering new bank products. You might also like this infographic, "Beyond immediate fraud losses: How the costs and impacts of fraud snowball." download NOW Takeaway 1 Fraud losses totaled $485.6

Abrigo

FEBRUARY 25, 2022

The year 2021 saw a continuation of pandemic policies and changes, a new administration in Washington , and regulatory reform from the Financial Crimes Enforcement Network ( FinCEN ). According to a 2021 Crypto Crime Report ? Takeaway 2 Enhance policies, procedures, and processes for areas that will gain regulatory scrutiny? .

PYMNTS

DECEMBER 8, 2020

Panelists joining PYMNTS CEO Karen Webster included Ingo Money CEO Drew Edwards ; Wells Fargo Senior Vice President, Head of Global Payables, Treasury Management Michelle Ziolkowski ; and J.P. Morgan Managing Director Industry Head for Public Sector Treasury Services, Wholesale Payments Eva Robinson. Headaches, Everywhere.

CFPB Monitor

APRIL 1, 2021

Comments on the RFI must be received by June 1, 2021. fraud detection and financial crime monitoring). Augmenting risk management and control practices. They describe the following “particular risk management challenges” created by the use of AI: Lack of explanability as to how and AI uses inputs to produce outputs.

Cisco

JULY 12, 2022

A key challenge is managing iterations of infrastructure in global financial enterprises which have spanned 50+ years of digitization. This leads to many generations of installed technology sets with diverse hardware and software systems, all that need to be tracked and managed, secured, and audited. Infrastructure Management.

FICO

NOVEMBER 23, 2021

FICO has announced its panel of independent judges for the 2022 FICO® Decisions Awards , which honor businesses achieving outstanding results using analytics and decision management technology to grow their business, manage risk and reduce costs. He has an MBA from the Indian Institute of Management.

FICO

JUNE 15, 2023

Wed, 03/08/2023 - 22:14 jessica shortt by TJ Horan Vice President, Product Management expand_less Back to top Thu, 06/15/2023 - 15:05 As someone who has made a career in the payments industry, I feel a little weird making this bold statement: it has become too easy to send money to other people. billion reported in 2021.

Independent Banker

OCTOBER 1, 2022

Cyber insurance not only provides financial reimbursement for losses; it also equips the insured with access to a list of preapproved incident response experts that are required to help the bank manage a cyber event. Regulators paying closer attention to cyber risks. Authentication: Protect against unauthorized access.

CFPB Monitor

JUNE 30, 2022

Of special note, the OCC also believes compliance risk is “heightened” for Bank Secrecy Act/Anti-Money Laundering (BSA/AML) and Office of Foreign Assets Control (OFAC) compliance because of world events and compliance staffing concerns. BSA/AML Compliance Risks.

Abrigo

FEBRUARY 8, 2024

Client fraud education to prevent banking losses Financial institutions play a crucial role in safeguarding customers and members from fraud. Fraud education is key. You might also like this infographic: 5 Fraud typologies impacting you and your customers or members. DOWNLOAD Takeaway 1 U.S.

Independent Banker

DECEMBER 31, 2021

If 2020 was the year no one expected, 2021 was a year of resetting expectations. Between a smoldering pandemic, the divisive political landscape and strong, albeit uneven, growth, there was a lot to account for in 2021, and some uncertainty remains. Illustration By blindSALIDA. What changes will 2022 bring? Click to enlarge.

Abrigo

OCTOBER 9, 2019

In a recent survey by the National Association for Business Economics, 74% of economists who responded expect a recession by the end of 2021. Additionally, it is important to remember that CECL is an accounting exercise while stress testing is a regulatory or institution risk management process. Portfolio Risk & CECL.

FICO

JUNE 7, 2022

These credit card performance figures represent a national sample of approximately 38 million consumer accounts from FICO client reports generated by the FICO® TRIAD® Customer Manager and Adaptive Control System solutions. The average total sales in December 2021 were at a two-year high point. year-over-year. See all Posts.

FICO

FEBRUARY 22, 2021

The year is still young - what predictions do you have on the subject of AI for 2021? And third, in 2021 I believe consumers will increasingly provide consent for specific, prescribed and constrained uses of their data, which will become ever more important in fraud detection, risk management and marketing.

FICO

JULY 15, 2022

In fact, top performers are now either partially or fully delivering automated claims management underpinned by a cloud infrastructure. It includes rapid application development, optimization and automated claims management, as well as accelerated underwriting decisions that help agents stay one-step ahead of the competition.

FICO

JANUARY 19, 2022

From TBML to BNPL to NFTs, 2021 found fraud and financial crime professionals dealing with a plethora of new challenges and criminal schemes. Our five most popular posts of the year dealt with trade-based money laundering, non-fungible tokens, buy now pay later scams, courier scams and good old credit card fraud.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content