Wells Fargo Freezes New HELOCs As Mortgage Market Sputters

PYMNTS

MAY 1, 2020

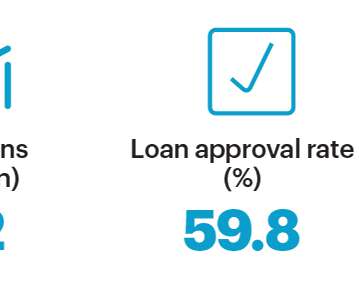

One of the nation’s biggest names in mortgage lending has put the brakes on home equity lines of credit (HELOC) as the economic turmoil caused by COVID-19 is making the U.S. Last month, the bank raised the minimum credit score for home equity loans to 720, up from 680. mortgage market look shaky. Wells Fargo & Co.

Let's personalize your content