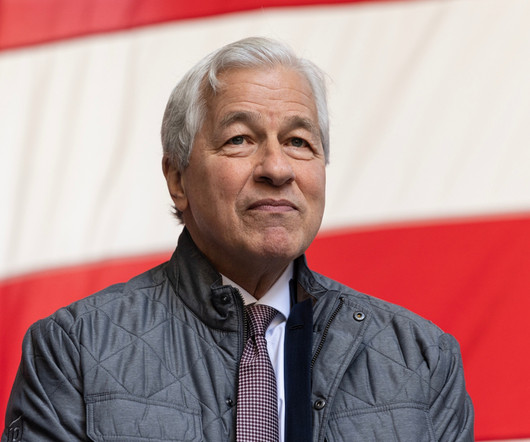

Ant Group Overhauling Operations To Satisfy Chinese Regulators

PYMNTS

JANUARY 15, 2021

After having its $37 billion dual IPO pulled by Beijing, Jack Ma’s Ant Group is working fast to overhaul operations to comply with government regulations, The Wall Street Journal reported on Friday (Jan. Chinese financial regulators called Ma and his leadership team to answer questions on the eve of the company’s stock market debut.

Let's personalize your content