Personalized Marketing: What Banking Customers Really Want

Perficient

APRIL 20, 2023

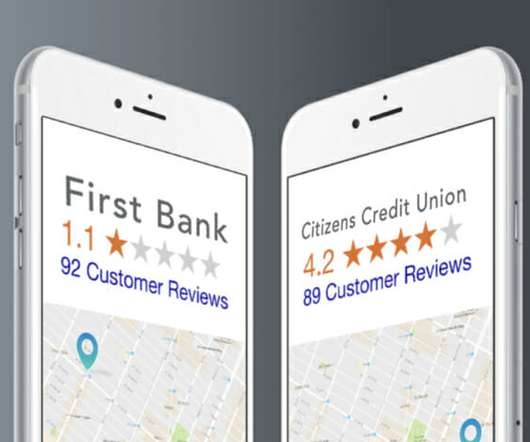

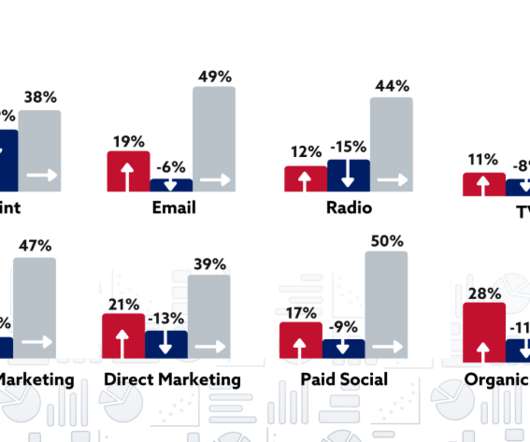

Marketers often turn to technology vendors to help them define robust and compliant digital marketing strategies. Bankers that have a defined digital marketing strategy are seeing greater lead generation and client acquisition.

Let's personalize your content