Why community banks should partner with fintechs

Independent Banker

JANUARY 31, 2022

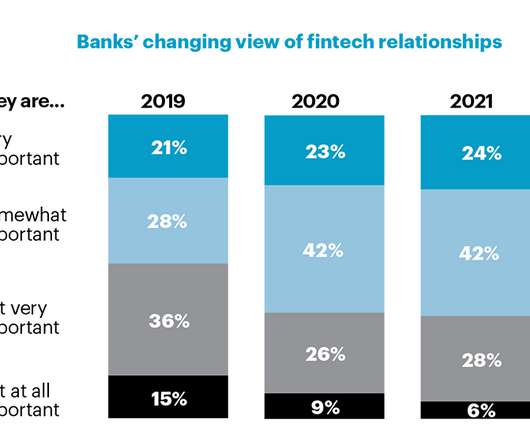

With consumer expectations seeming to evolve faster every year, community banks could consider partnering with a fintech to keep up with technological innovation. Those conversations, he says, centered around whether community banks could compete against this brash group of newcomers. Photo by Pogonici/iStock. Quick Stat.

Let's personalize your content