Report: $50B In Cryptocurrency Moved Out Of China

PYMNTS

AUGUST 21, 2020

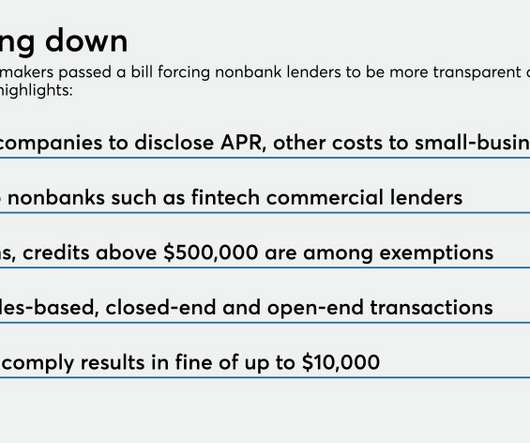

While Chinese traders are limited to the purchase of up to $50,000 of foreign currency annually, the volume suggests stablecoins could be being used to circumvent the regulation, according to Chainalysis , the New York-based provider of regulatory compliance software.

Let's personalize your content