Social Media Network Nextdoor Eyes IPO

PYMNTS

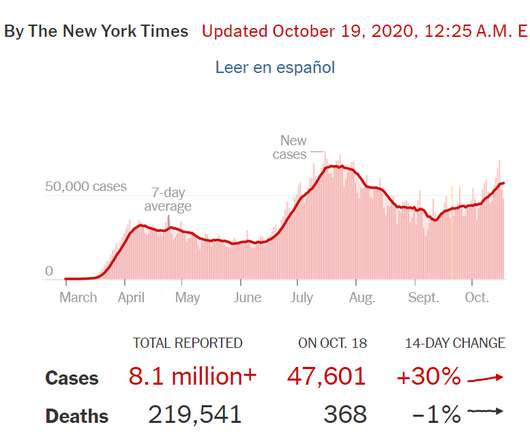

OCTOBER 18, 2020

a social media network that is something of a combined Facebook, Craigslist and Yelp and whose members connect only with neighbors, is exploring going public, Bloomberg News reported. Nextdoor Inc. , Nextdoor didn’t respond to requests for comment, Bloomberg added. billion after a funding round in September 2019.”.

Let's personalize your content