How to Use RFM Customer Segmentation Analysis in Banking

South State Correspondent

DECEMBER 14, 2023

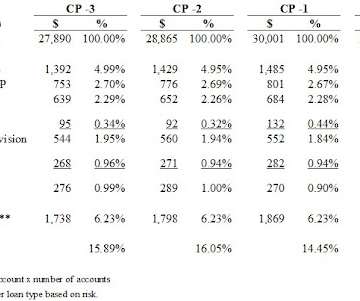

In banking, there is often a discussion about “who are our best customers?” ” Some banks rank customers against current profitability, others against lifetime profitability, and some use a technique called “RFM,” which stands for “Recency,” “Frequency,” and “Monetary.”

Let's personalize your content