CFPB Releases Study of Refinance Mortgage Loans Between 2013 and 2023

CFPB Monitor

DECEMBER 20, 2023

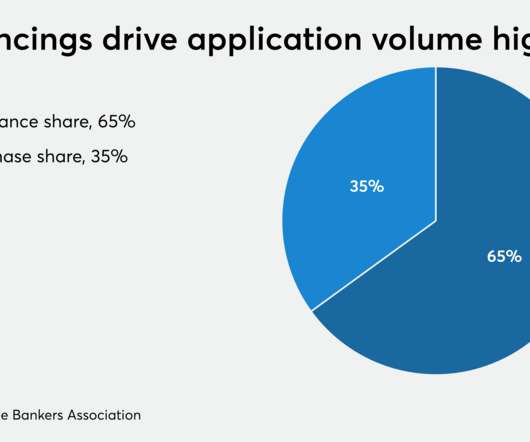

The CFPB recently released results of a study of residential mortgage refinance loans from the first quarter of 2013 to the first quarter of 2023, focusing on differences between cash-out and non-cash-out (or rate and term) refinance loans. The CFPB used data from the National Mortgage Database to conduct the study. Continue Reading

Let's personalize your content