Deep Dive: How Regulatory Compliance Tools Help Keep Remittances Flowing

PYMNTS

SEPTEMBER 24, 2020

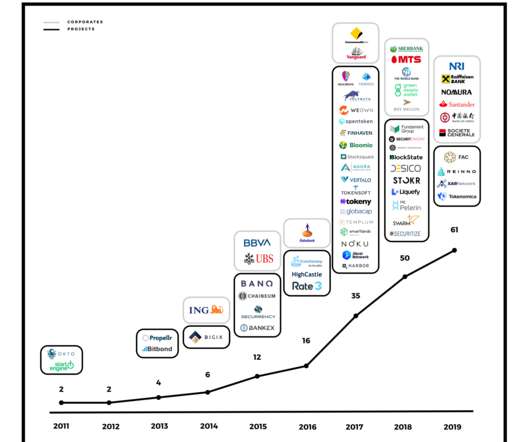

Reducing fees for remittances might push price points low enough that more consumers could resume sending money home, though, and some researchers believe that money transfer service providers could make such price adjustments if they are able to reduce their own expenses through more robust and cost-effective regulatory compliance measures. .

Let's personalize your content