JPMC: Why Working-Capital Trade Finance Is On The Rise

PYMNTS

AUGUST 4, 2020

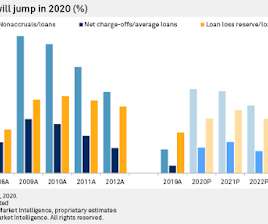

Although the 2008 financial crisis jolted the world economy, the financial conditions leading up to the disruption had been a long time coming. Lessons Learned From 2008. “That needs to be financed,” Fraser said, “and it’s creating pressure on working capital that needs to be sized appropriately.”

Let's personalize your content