Bitesize: Emerging market currency risk: evidence from the COVID-19 crisis

BankUnderground

JULY 24, 2020

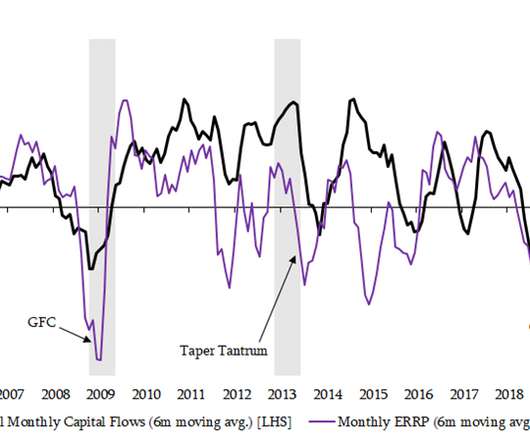

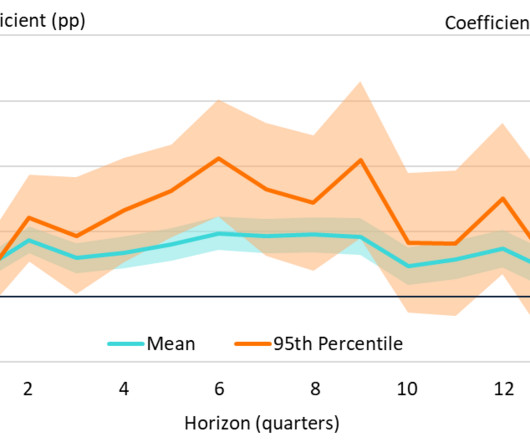

A striking regularity around global economic crises is that the dollar tends to appreciate sharply against emerging market (EM) currencies as capital flows out of EMs. In a recent CEPR e-book chapter , we compare recent exchange rate moves and capital flow adjustments to past global crises. for 2005-2020.

Let's personalize your content