Banking top guns can boost mortgages with new tech

Accenture

DECEMBER 14, 2022

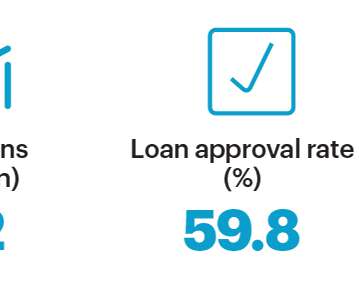

Yes, mortgage rates are at a 14-year high and volume is off by more than 80%. I figure if you work in the mortgage industry you have a lot of free time on your hands right now and are…. The post Banking top guns can boost mortgages with new tech appeared first on Accenture Banking Blog.

Let's personalize your content