Brexit Raises The Stakes For B2B Payments Fraud

PYMNTS

DECEMBER 28, 2020

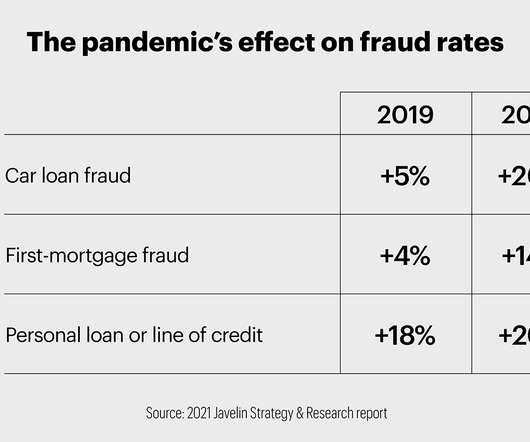

Nacha is issuing a warning to accounts payable professionals with regards to the rising threat of fraud. Further, Nacha said, the survey revealed AP professionals are facing increasing fraud attempts that target AP processes specifically. But accounts payable is far from the only back-office financial workflow at risk of fraud.

Let's personalize your content