The real reason people don’t change banks

Chris Skinner

NOVEMBER 26, 2019

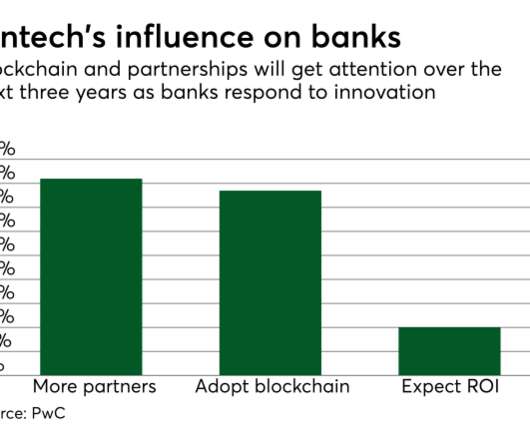

Interesting conversation about switching accounts. I’ve had a few people saying that banks don’t have loyal customers, but they have trapped customers. By way of example, an email from a friend: I am just exactly as loyal to my bank as they are to me, which is to say not … The post The real reason people don’t change banks appeared first on Chris Skinner's blog.

Let's personalize your content