Restoring production DXP content for local Episerver development

Perficient

NOVEMBER 19, 2020

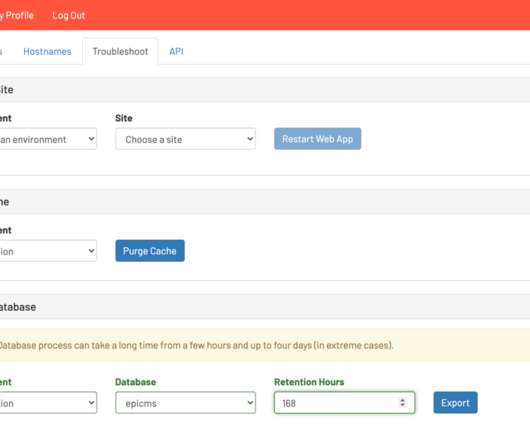

While developing new features in Episerver CMS, it can be incredibly useful to have a local copy of the production content. Here are the steps required for extracting content from Episerver’s DXP platform and restoring it into your local environment for development. Step 1: Request a database backup from the PaaS portal. The first step in the process is the only one you can’t fully control.

Let's personalize your content