Bank Regulators Seeking Comments on the Use of AI and ML in the Industry

Perficient

APRIL 2, 2021

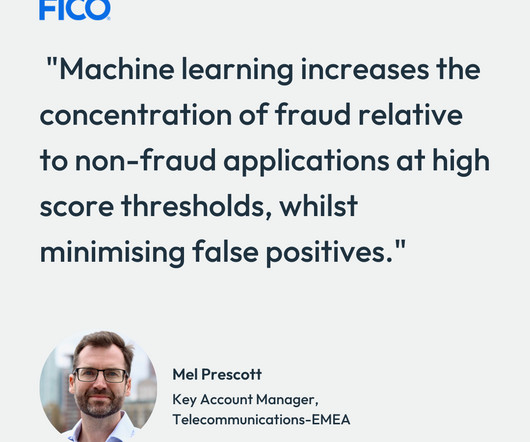

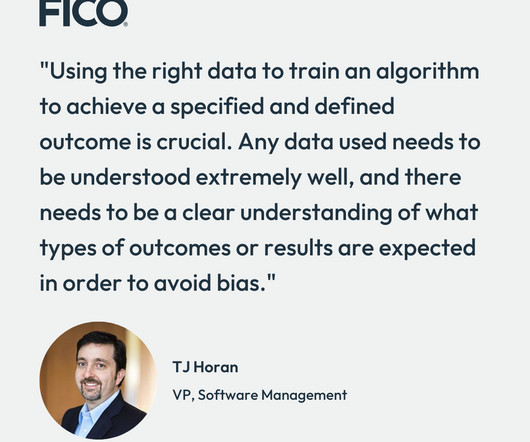

fraud detection and financial crime monitoring). email, text, audio data), with the aim of identifying fraud or anomalous transactions. Personalization of Customer Services. One example is the use of chatbots to automate routine customer interactions, such as account opening activities and general customer inquiries.

Let's personalize your content