FDIC’s New Banker Engagement Site (BES): Improving CRA & Compliance Exam Communication

Perficient

SEPTEMBER 11, 2023

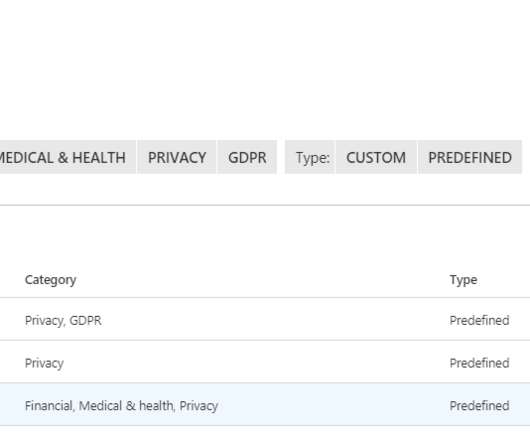

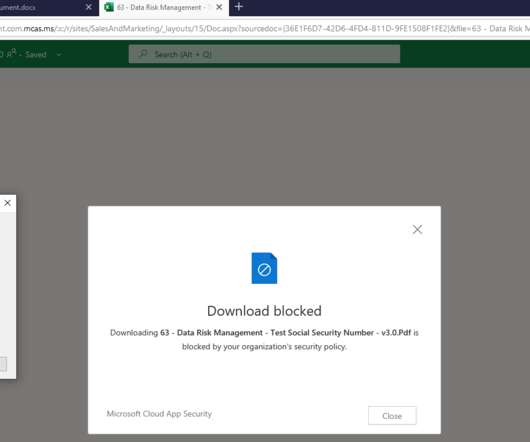

Already reviewed by Perficient, BES provides a secure and efficient portal to exchange documents, information, and communications for consumer compliance and Community Reinvestment Act (CRA) examinations. Expert CRA Partners Our industry experts stay on top of the latest CRA tools and bring that ready know-how to our client engagements.

Let's personalize your content