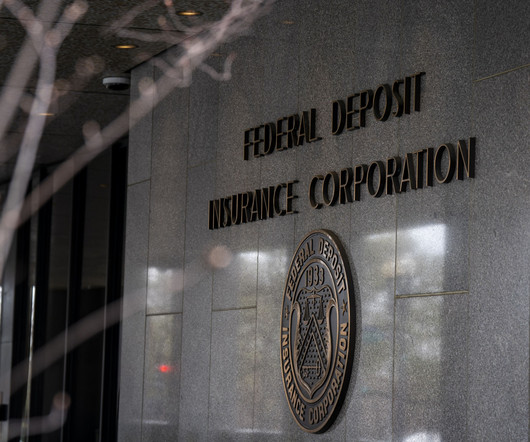

FDIC Releases Latest Information Regarding the Deposit Insurance Restoration Plan

Perficient

DECEMBER 29, 2023

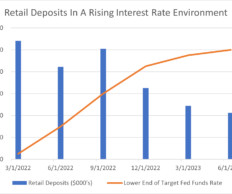

Since that blog was published, the FDIC has issued an update on its Restoration Plan for the Deposit Insurance Fund (DIF). The Federal Deposit Insurance Act (FDI Act) requires the FDIC Board to adopt a restoration plan when the DIF’s reserve ratio—the ratio of the fund balance relative to insured deposits—falls below 1.35

Let's personalize your content