Top 6 Trends for the Banking Industry in 2024

Perficient

FEBRUARY 29, 2024

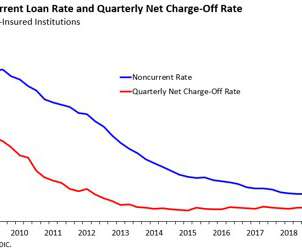

Utilize advanced algorithms and data analytics to enhance risk assessment methodologies, allowing banks to identify and mitigate default risks more effectively, thereby making more informed lending decisions. Facilitation of embedded lending while ensuring compliance: Embedded finance initiatives must adhere to regulatory requirements.

Let's personalize your content