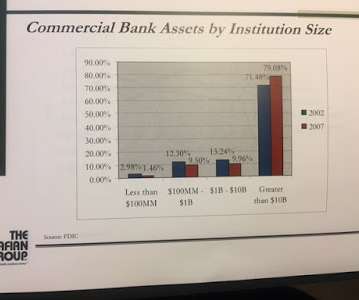

How National Banks Are Poaching Loans and Deposits

South State Correspondent

MAY 15, 2023

community bank management team. The CLO was lamenting how he was losing quality loans and deposits to three aggressive national banks in the territory. While this community bank is not aggressively pricing new loans, losing this commercial credit with a substantial deposit relationship was painful. Last week we spoke to a $1.2B

Let's personalize your content