Opportunities in Partnership: Community Banks Can Benefit from Today’s FinTechs

Independent Banker

DECEMBER 1, 2021

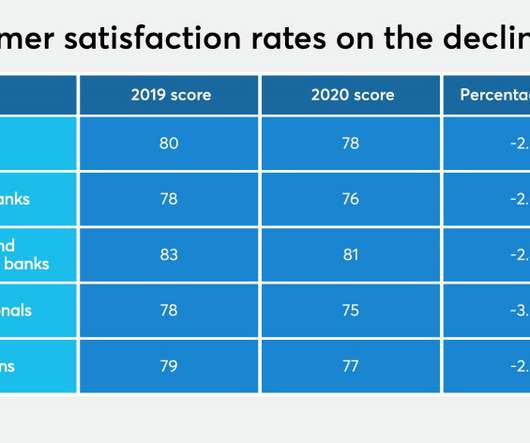

50% of consumers now interact with their bank through mobile apps or websites weekly – up from 32% two years ago. Additionally, a recent survey by FIS shows that 37% of consumers began a new banking relationship with a major national or global bank that had a well-established online portal in the past 12 months.

Let's personalize your content