China’s P2P Lending Crackdown Leaves $115B In Losses

PYMNTS

AUGUST 14, 2020

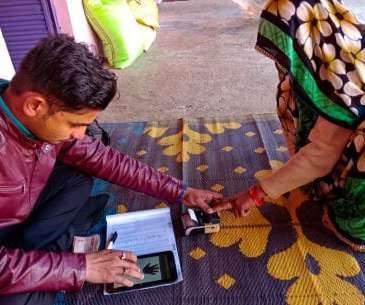

China’s peer-to-peer (P2P) lending sector, once 6,000 businesses strong, has been reduced to fewer than three dozen as the government tightened regulations, leaving billions in loans unpaid. Regulators and law enforcement will try their best to recoup the money, he told China Central Television Friday (Aug. 14), per the report.

Let's personalize your content