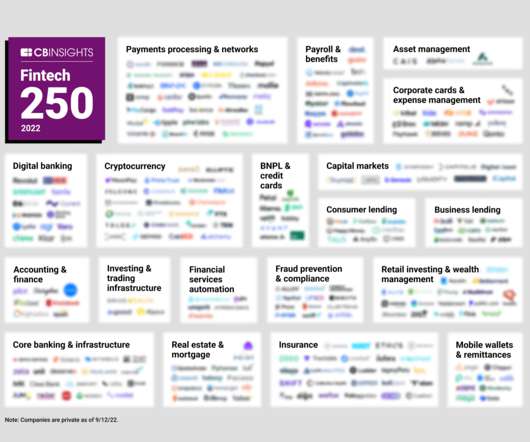

Canadian Fintech Market Map

CB Insights

NOVEMBER 21, 2019

Finally, looking at Canadian “fintech” (financial technology) specifically, funding was up substantially in the first half of the year. Canadian fintech companies raised $251M through the end of H1’19, nearly double the $133M raised in H1’18. The 2019 Canadian fintech market map. Data is as of 10/8/2019.

Let's personalize your content