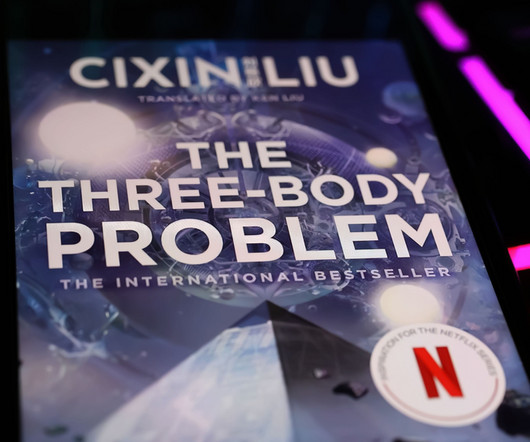

Solving the Three-Body Problem in Banking

South State Correspondent

APRIL 23, 2024

Banking has a similar physics problem when management juggles strategy, risk/profitability, and customer behavior. This article will discuss the challenge of managing three potentially opposing forces and look towards physics to help us solve the mystery. Here, customer behavior is known, monitored, and managed.

Let's personalize your content