Cross-Selling and Upselling – 2 Drivers of Relationship Profitability

South State Correspondent

MARCH 19, 2024

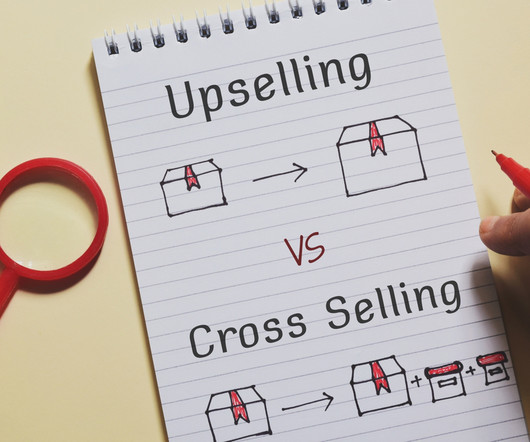

In two previous articles ( here and here ) we discussed how loan size and loan term affect the profitability of commercial loans. In this article, we consider the common features of upselling and cross-selling. In this article, we consider the common features of upselling and cross-selling.

Let's personalize your content