DevSecOps Best Practices ? Automated Compliance

Perficient

JUNE 5, 2020

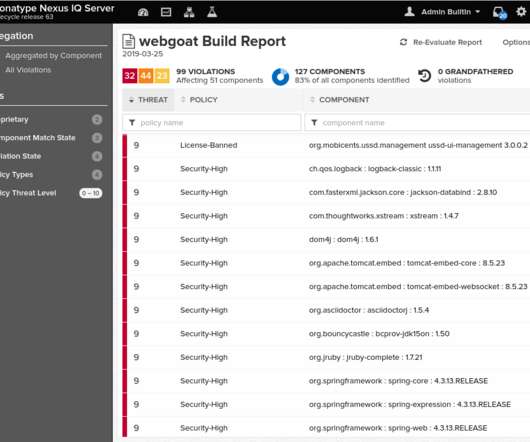

As a best-practice it is recommended to adopt automation of certain security audits, integration of compliance oversight into key development process areas (e.g. Source Code Analysis. Dynamic Application Analysis. Intake, Construction, Release Management), and DevOps pipeline tooling. SonarQube Security Scan Result.

Let's personalize your content