Top 6 Trends for the Banking Industry in 2024

Perficient

FEBRUARY 29, 2024

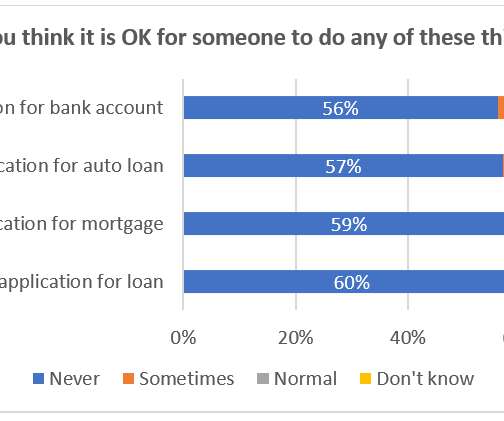

Through the analysis of diverse data sets, automation of loan processing, and consideration of varied factors, financial institutions are not only increasing customer satisfaction and reducing operational costs but also fostering resilience in the face of evolving economic landscapes.

Let's personalize your content