Robert Fisher: The nimbleness of community bankers

Independent Banker

DECEMBER 31, 2021

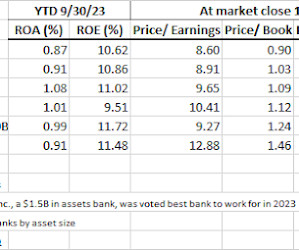

Let’s rediscover what it means to be community bankers. Because as community bankers, it’s what we do. That just may be community bankers’ word of the year. As we enter 2022, we are balancing low margins, high wages, too much liquidity and a lack of loan demand, and we have our work cut out for us. My Top Three.

Let's personalize your content