Will the cost of regulation impact community bank customers?

Abrigo

FEBRUARY 2, 2015

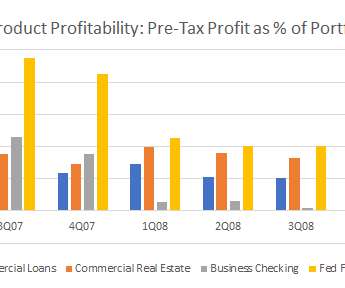

The banking industry has seen a steady stream of media attention since 2008, much of it in the form of stories about data breaches linked to major retailers or mega banks’ profits. With more of a community bank’s operating costs being eaten up by the regulatory burden, the numbers need to shift from another column.

Let's personalize your content