JPMC: Why Working-Capital Trade Finance Is On The Rise

PYMNTS

AUGUST 4, 2020

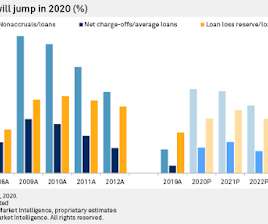

Although the 2008 financial crisis jolted the world economy, the financial conditions leading up to the disruption had been a long time coming. Lessons Learned From 2008. It’s perhaps the biggest economic difference between then and the current climate, in which a global pandemic thrust millions of workers in the U.S.

Let's personalize your content