Denmark’s Ex-Finance Regulator Charged In Money Laundering Scandal

PYMNTS

MAY 13, 2019

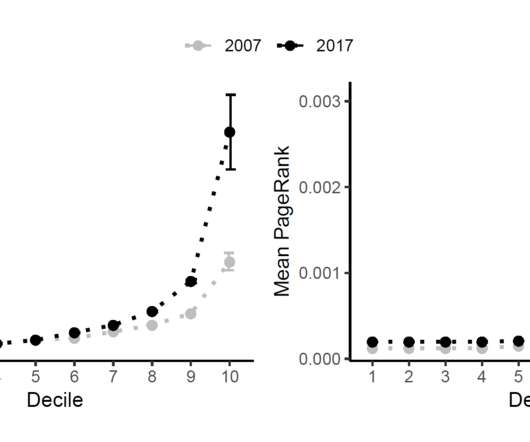

Henrik Ramlau-Hansen, the former chair of Denmark’s financial regulator and former Danske Bank finance director, has been charged by Danish economic prosecutors. He resigned in 2018 at the same time a scathing Danske report from the regulator was issued. The money laundering went on from 2007 to 2015.

Let's personalize your content