Should You Be Marking Loans To Market?

South State Correspondent

NOVEMBER 7, 2022

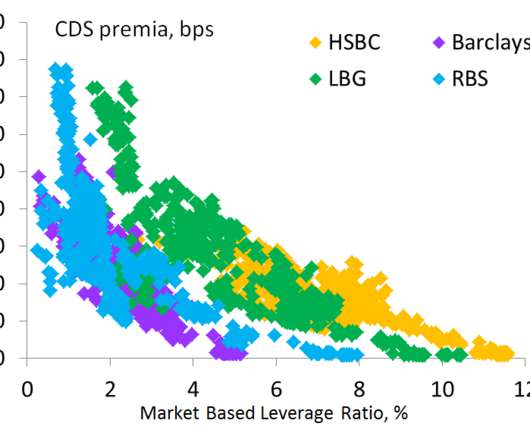

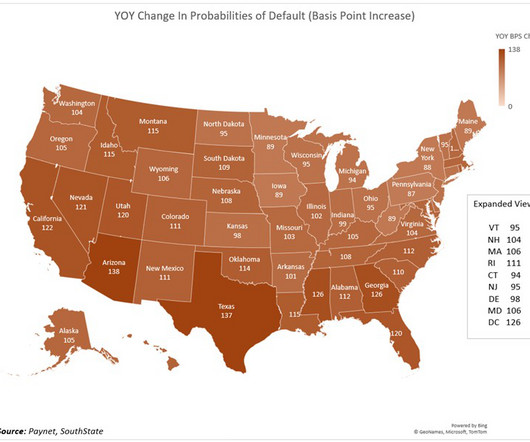

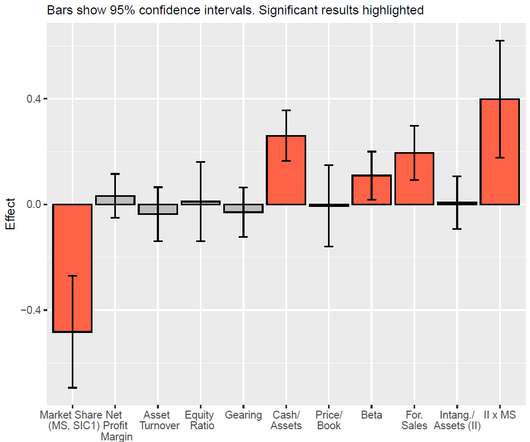

The AOCI is an accounting adjustment meant to reflect the economic value of assets and is the process of “marking loans to market.” In this article, we explore what signals marking your loans to market might send. It was back in August of 2007 when credit spreads started to widen. Capital got scarce.

Let's personalize your content