Lending standards slip, risk increasing according to OCC

Abrigo

DECEMBER 16, 2014

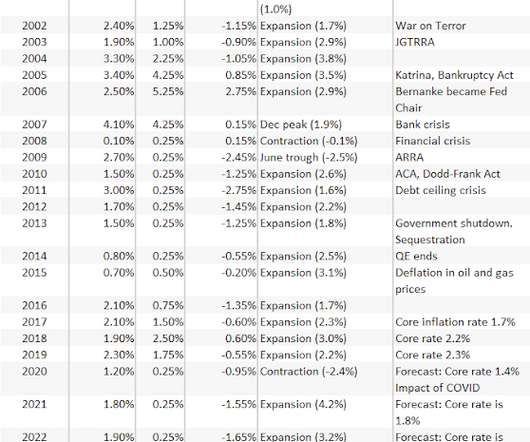

Lending standards continue to relax, according to data from the OCC’s 2014 Survey of Credit Underwriting Practices. This type of easing is similar to that experienced between 2004 and 2006, the time period leading up to the financial crisis, which many attribute to inadequate lending standards.

Let's personalize your content