Deep Dive: How FIs Can Keep Their Digital-First Innovations Secure

PYMNTS

JANUARY 27, 2021

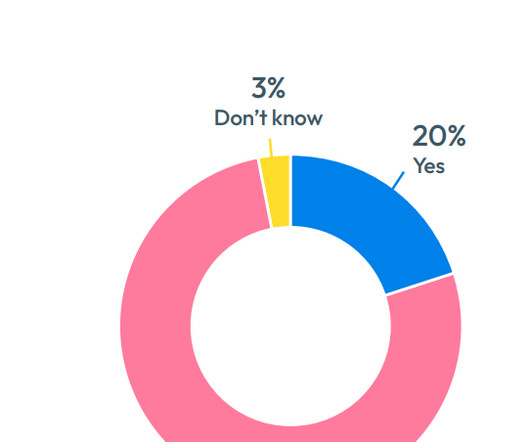

Banks’ use of such innovations is predicted to expand, too, with 60 percent of FIs saying they aim to gain customers and improve customer experiences using digital channels. Lackluster customer onboarding authentication is one of the weakest points in most banks’ anti-fraud security systems. How Authentication Prevents Fraud.

Let's personalize your content