The true cost of fraud

Abrigo

NOVEMBER 17, 2023

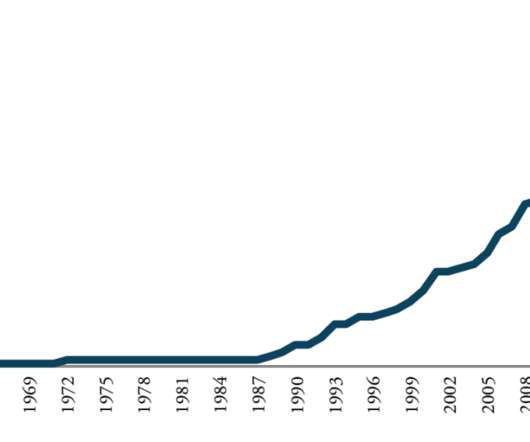

Measuring the cost of fraud losses. The true cost of fraud goes beyond the initial reported fraud losses Would you like other articles like this in your inbox? Takeaway 1 Fraud scams made worse by the pandemic continue to be successful, while crypto-scams are emerging. That equates to $35 billion annually.

Let's personalize your content