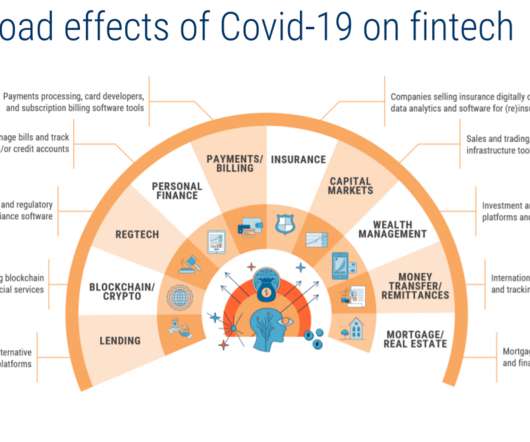

Fintech and Consumer Finance: Agenda for 2021 webinar to be held on December 9-10

CFPB Monitor

NOVEMBER 16, 2020

On December 9-10, 2020, the Conference on Consumer Finance Law and the Program on Financial Regulation & Technology at George Mason University’s Scalia Law School is sponsoring a webinar that will examine emerging issues in the areas of fintech and consumer finance. The full webinar agenda is available here.

Let's personalize your content