A future look back at how COVID-19 changed the payments space

Payments Dive

JUNE 9, 2020

PPRO takes a future view of how COVID-19 may permanently change the payments landscape.

Payments Dive

JUNE 9, 2020

PPRO takes a future view of how COVID-19 may permanently change the payments landscape.

PYMNTS

JUNE 12, 2020

As the use of mobile banking apps surges due to the limited access to banks amid the COVID-19 pandemic, the FBI is warning users to beware of cyber attacks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

JUNE 8, 2020

With many US cities emerging from lockdown, businesses are considering their next moves, but some fear their window to act has passed. Even with lockdown restrictions loosening, re-entry into the world isn’t going to happen overnight, and even when it does happen, how people make their way in the world has changed forever. Reopening has started.

Chris Skinner

JUNE 8, 2020

I blog about so many things. Sure, most of the time it’s FinTech, banking and technology. Sure, most of the time it’s about the future, the outlook, the ideas. But quite often I find myself returning to topics that I’m passionate about: diversity, equality, inclusion, climate protection, the future, our … The post FinTech can’t tackle financial services without tackling its diversity problem appeared first on Chris Skinner's blog.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

JUNE 12, 2020

Over the next 18 months, Starbucks will increase convenience-led formats in company-operated locations with drive-thru and curbside pickup options, as well as its Pickup locations, according to a filing with federal regulators.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Perficient

JUNE 9, 2020

Many times while working on a project you might encounter a situation where you need to add the same type of structure is to multiple pages. To get accomplish this, you need to add the same piece of code again and again. This use to be a struggle many developers dealt with during site builds. Now, we can get rid of this repetitive task by using Sitecore’s “HTML snippet feature with Rich Text Editor”.

Chris Skinner

JUNE 7, 2020

Things we’re reading today include … You may be in love, but you should always have your OWN bank account Bank boss tells lenders to be ready for no-deal Brexit Digital IDs could end the need for in-bank visits and banish passwords £36bn of government-backed loans will be toxic, taskforce … The post Things worth reading: 8th June 2020 appeared first on Chris Skinner's blog.

Accenture

JUNE 9, 2020

In my previous posts in this series, I talked about the importance of getting technology, security, operating models and governance right when navigating the Open Banking journey. An equally crucial factor is the activation of the ecosystem. Open Banking requires and depends on partnerships—from suppliers to business collaborators and from vendors to customers.

PYMNTS

JUNE 7, 2020

Chuck E. Cheese , the popular food and games chain, is talking to investors about ways to raise money to avoid filing for bankruptcy, The Wall Street Journal reports. The chain has also approached lenders in the past few weeks to feel out possible interest in a $200 million loan to help pay for a stay in bankruptcy, a source said, as reported by WSJ.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Perficient

JUNE 8, 2020

The COVID-19 pandemic has been a trying time for people across the world and has brought uncertainty and fear into the lives of many. However, even in these difficult times, there are always people who find ways to bring a little light and make a difference in any way they can. Our Chicago team members fit right into this category when they dedicated a night to making masks for themselves and their friends and families.

Chris Skinner

JUNE 9, 2020

I was recently asked to respond to the idea that men are not supporting diversity enough. It was for a blog update by Darren Franks on his website talentinthecloud.io. Of course, I said yes. Here’s the result … FinTech needs more men! Yes, you read this right, the FinTech sector … The post FinTech needs more men! appeared first on Chris Skinner's blog.

Bobsguide

JUNE 10, 2020

By Andries Smit, CEO and founder of Upside. There are 11.95m+ households in the UK with less than £1,500 in savings. Since early March, the catastrophic impact of the coronavirus has only highlighted further the treacherous situation the country is facing regarding personal savings. For the.

PYMNTS

JUNE 10, 2020

TikTok , the popular Chinese short-form mobile video app, is facing more scrutiny over its privacy policies, Bloomberg reported. The EU’s investigative unit will form a task force to examine TikTok’s activities across the 27-nation bloc following a request from a lawmaker concerned about its data collection and its security and privacy risks. EU authorities can fine companies for violations under the General Data Protection Regulation (GDPR).

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Perficient

JUNE 12, 2020

“Perficient is a recognized leader in the digital consulting space, and I’m thrilled to be joining a team whose pride for their people is so immediately apparent,” shares Andrea Lampert , Vice President of People at Perficient. “In addition to the tremendous pride, there is a true service mentality and really smart people doing amazing work.”.

Chris Skinner

JUNE 6, 2020

The main blog headlines are … No one changes behaviour … unless forced to I see lots of surveys and research about the use of technology in finance. Things like 47 percent of consumers are interested in biometric payments or 80 percent of consumers would use mobile payments. Then you … The post The Finanser’s Week: 1st June 2020 – 7th June 2020 appeared first on Chris Skinner's blog.

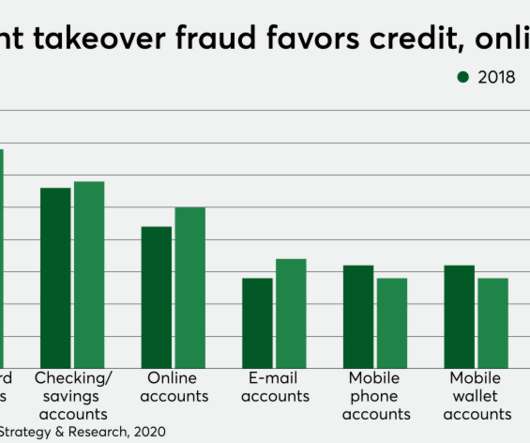

Payments Source

JUNE 9, 2020

Identity fraud holds no prisoners when it comes to payments. If a fraudster gets hold of a consumer's credentials, everything from mobile wallets, to a checking account, savings account or P2P account is in jeopardy of takeover.

PYMNTS

JUNE 11, 2020

Singapore-based cross border-payments platform TranSwap will partner with Currencycloud , which provides B2B embedded cross-border solutions, to let businesses collect and hold numerous currencies in the U.S., U.K., EU and other countries, a press release states. By using Currencycloud Spark, TranSwap will be able to offer the Global Borderless Virtual Account (GBVA) to customers, enabling funds to be held in 34 currencies and allowing more flexibility for cross-border payment solutions, through

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Perficient

JUNE 11, 2020

Over the last few years, Oracle has been hard at work developing its newest flagship clinical trials platform called Clinical One. The company has invested a significant amount of money and personnel in building the platform. While there are many more capabilities to come over the next few years, you can already leverage Clinical One for data collection, randomization, and trial supplies management.

Chris Skinner

JUNE 9, 2020

Things we’re reading today include … UK banks approve £35bn in state-backed loans amid heavy demand Exclusive: Banks to Berlin – Loosen coronavirus cash rules for firms Turkey joins settlement house Euroclear after 8-year talks Pompeo chides HSBC for ‘corporate kowtow’ to Beijing Amanda Staveley exaggerated role in Barclays rescue, … The post Things worth reading: 10th June 2020 appeared first on Chris Skinner's blog.

Bobsguide

JUNE 11, 2020

Starting in March, banks including Llyods and HSBC have closed their branches due to government guidelines on health and safety – a trend that has led to a drastic change in consumer behaviour and that has accelerated the digital transformation of retail banks. Mladen Vladek, general.

PYMNTS

JUNE 12, 2020

Trillions of dollars in federal COVID-19 stimulus payments are being disbursed through paper checks, prepaid debit cards and direct deposit

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Perficient

JUNE 11, 2020

Centene, a large multi-line managed care organization, was looking to modernize and streamline its corporate performance management (CPM) applications. Centene had to move data between platforms multiple times during the close process so that close data could be fully consolidated and made available for reporting. This process had numerous challenges and inefficiencies that Centene wished to improve upon so that they could provide a more streamlined and more transparent process to the functional

Chris Skinner

JUNE 10, 2020

Things we’re reading today include … ECB prepares ‘bad bank’ plan for wave of coronavirus toxic debt The Looming Bank Collapse Goldman Sachs employees to start returning to U.S. offices from June 22 Goldman Sachs closes Marcus account to new UK savers Mike Pompeo criticises HSBC for ‘corporate kowtow’ to … The post Things worth reading: 11th June 2020 appeared first on Chris Skinner's blog.

Bobsguide

JUNE 11, 2020

The gap in digital performance continues to grow between traditional banks and challengers as the pandemic exposes incumbents’ inability to adapt. Mark O’Keefe, founding director at Optima Consulting and Payments Systems Regulator (PSR) panel member, says few incumbents have.

PYMNTS

JUNE 9, 2020

Physical brick-and-mortar retail was suffering long before the pandemic. As the great shift to digital continues, the last three months have shown that consumers are not only used to conducting commerce in bits and bytes — they like it. Consider the findings of a PYMNTS consumer survey , where 42 percent of consumers are engaging in even the most routine activities online, and as much as $158 billion in brick-and-mortar sales are moving to digital channels.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Let's personalize your content