Banks limit lobby access, waive fees amid COVID-19

Payments Dive

MARCH 20, 2020

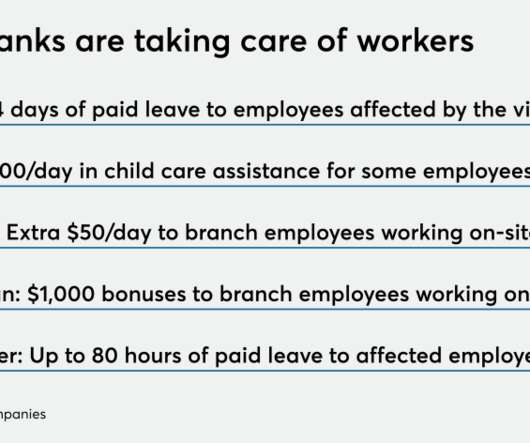

Banks across the U.S. are limiting lobby hours and encouraging mobile banking in response to the COVID-19 outbreak. Many banks continue to offer fee waivers and penalty reductions for customers that need to access funds early.

Let's personalize your content