The four tech trends for banks to outmaneuver uncertainty

Accenture

SEPTEMBER 28, 2020

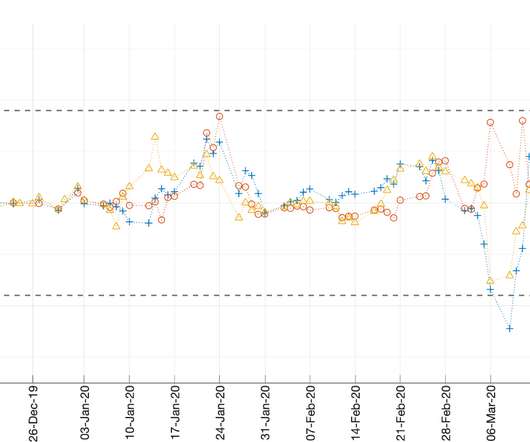

In my last post, I talked about how the pandemic has pushed banks’ digital transformation efforts to historic heights, according to our latest report, “Driving Value and Values During COVID-19.” Our report also identified four key technology trends shaping the post-COVID future. Today, let’s take a closer look at those and how they can help…. The post The four tech trends for banks to outmaneuver uncertainty appeared first on Accenture Banking Blog.

Let's personalize your content