Fraud Concerns and Trends in 2022

Abrigo

MAY 20, 2022

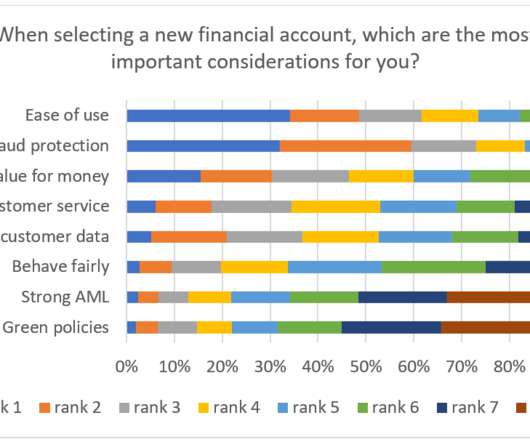

Fraud on Alert for 2022 A review of SAR data , government agenc y releases, a nd fraud findings found these f raud c oncerns and trends to wat ch in 2022. Takeaway 1 An Abrigo review of SAR data, government agency releases, and fraud findings revealed fraud trends to watch for. Fraud Concerns.

Let's personalize your content